Ministry of Corporate Affairs (MCA) revises the definition of “Small Company” to boost ease of doing business

Small companies represent the entrepreneurial capabilities of lakhs of people in the country.

Being a small company as per the provisions of the Companies Act 2013 (the Act), will give the advantages of running your business as a company with limited liability without the hassles of being bothered about too many compliance requirements and costs thereto. Yet another aspect that bothers businessmen is the consequences of delays and defaults exposing not only the company but also their directors to hefty monetary penalties.

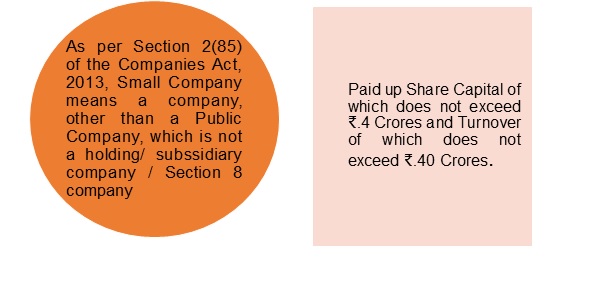

Since, companies with a gross annual turnover of Rs.40 Crores can now be regarded as a small company with the latest amendment under the Act which has come into force with effect from 15th September 2022, small businesses are entitled to review their business goals and models to see if it would be more advantageous for them to run their show as a small company by incorporating a company under the Act or by registering their existing partnership firms itself as a company so as to reap the twin benefits of being a limited company and a reduced tax on the profits.

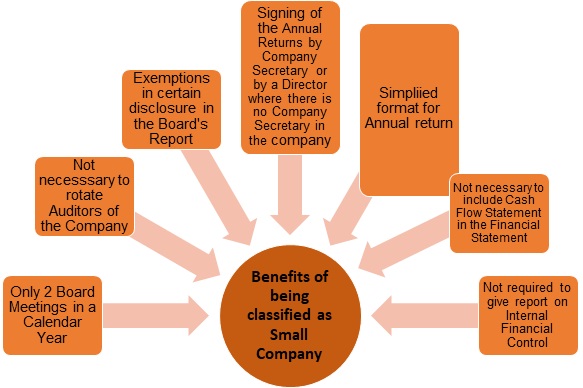

Benefits of being classified as Small Company

Small companies enjoy simpler compliance requirements. However, even if there are non-compliances arising from delays and defaults, the penalties are half the sum other companies are liable to pay and even that too subject to a maximum amount of penalty.

Hence, the increased threshold brought about by this latest amendment augurs well for small companies and is indeed a step in the right direction towards augmenting ease of doing business!

Note:

The Paid-up capital and Turnover referred to in the definition have to be reckoned based on the latest audited balance sheet of companies.

*******